A Biased View of Best Broker For Forex Trading

A Biased View of Best Broker For Forex Trading

Blog Article

6 Simple Techniques For Best Broker For Forex Trading

Table of ContentsEverything about Best Broker For Forex TradingNot known Facts About Best Broker For Forex TradingThe Basic Principles Of Best Broker For Forex Trading Best Broker For Forex Trading Can Be Fun For AnyoneThe Main Principles Of Best Broker For Forex Trading

Since Foreign exchange markets have such a huge spread and are used by a substantial variety of participants, they provide high liquidity in contrast with various other markets. The Forex trading market is continuously operating, and thanks to contemporary innovation, is easily accessible from anywhere. Hence, liquidity describes the truth that any individual can buy or sell with a basic click of a switch.As an outcome, there is always a potential seller waiting to acquire or market making Forex a fluid market. Price volatility is one of the most essential factors that aid make a decision on the following trading step. For temporary Forex traders, price volatility is crucial, because it shows the hourly changes in a property's value.

For long-lasting capitalists when they trade Forex, the price volatility of the market is additionally basic. Another considerable benefit of Foreign exchange is hedging that can be used to your trading account.

The smart Trick of Best Broker For Forex Trading That Nobody is Discussing

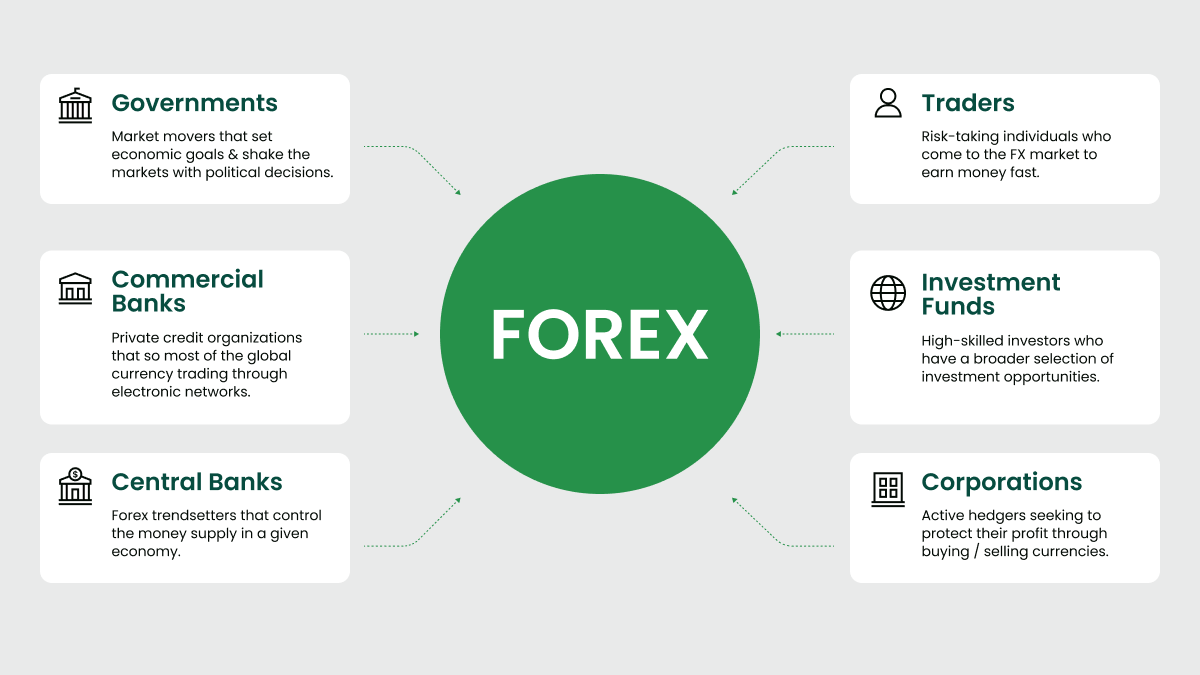

Depending on the moment and effort, traders can be separated right into groups according to their trading style. Some of them are the following: Forex trading can be efficiently used in any of the strategies over. Additionally, as a result of the Forex market's great quantity and its high liquidity, it's possible to get in or leave the marketplace whenever.

Foreign exchange trading is a decentralized modern technology that operates with no central management. A foreign Forex broker should conform with the standards that are specified by the Foreign exchange regulatory authority.

Thus, all the transactions can be made from anywhere, and because it is open 24 hours a day, it can additionally be done at any moment of the day. If a capitalist is situated in Europe, he can trade during North America hours and check the steps of the one money he is interested in.

The Of Best Broker For Forex Trading

Most Forex brokers can use a really reduced spread and lower or even eliminate the investor's costs. Investors that pick the Forex market can improve their revenue by staying clear of fees from exchanges, down payments, and various other trading activities which have extra retail transaction expenses in the stock market.

It gives the option to get in the market with a little spending plan and trade with high-value currencies. Some traders might not fulfill the demands of high leverage at the end of the deal.

Foreign exchange trading might have trading terms to secure the marketplace participants, yet there is the threat that somebody may not value the concurred contract. The Forex market works 24 hours without stopping. Traders can not keep an eye on the changes daily, so they use formulas to protect their interests and their financial investments. Therefore, they require to be frequently notified on just how the technology works, otherwise they may face great losses throughout the night or on weekend breaks.

When retail investors describe cost volatility in Forex, they mean how huge the growths and downswings of a currency pair are for a particular period. The larger those ups and downs are, the higher the rate volatility - Best Broker For Forex Trading. Those huge modifications can stimulate like it a feeling of uncertainty, and in some cases traders consider them as an opportunity for high profits.

All About Best Broker For Forex Trading

Several of the most volatile money pairs are thought about to be the following: The Forex market supplies a great deal of opportunities to any Forex trader. When having actually determined to trade on fx, both knowledgeable and newbies require to specify their monetary strategy and get accustomed to the conditions.

The content of this post reflects the writer's viewpoint and does not necessarily mirror the official placement of LiteFinance broker. The product published on this web page is offered informational functions just and must not be considered as the arrangement of investment suggestions for the objectives of Directive 2014/65/EU. According to copyright law, this post is taken visit this web-site into consideration intellectual building, that includes a prohibition on copying and dispersing it without approval.

If your business operates globally, it is very important to comprehend just how the worth of the united state buck, family member to other money, can dramatically influence the rate of products for U.S. importers and exporters.

Indicators on Best Broker For Forex Trading You Need To Know

In the early 19th century, money exchange was a huge part of the operations of Alex. Brown & Sons, the first financial investment financial institution in the United States. The Bretton Woods Contract in 1944 required currencies to be pegged to the United States dollar, which remained in turn pegged to the price of gold.

Report this page